iSense Solutions study: 64% of Romanians want more digitalized banks in Romania

Two thirds of Romanians said that they want more digitalized banks in Romania, according to an iSense Solutions study developed in June, on the Internet users present in urban. The study,launched in order to research the Romanians’ openness regarding the modern banking services, investigated also what is the awareness and the adoption rate of Revolut, a digital banking service launched in Romania this year.

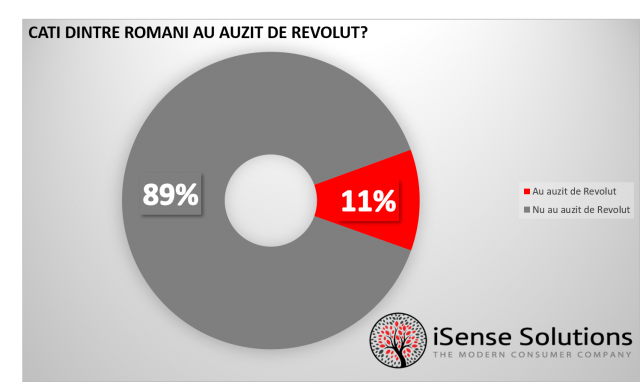

The study’s results show that 11% of the Romanians heard of Revolut. Among the ones using it, most of them (36%) used it abroad, a third (33%) in order to exchange foreign currency, 30% as a method of paying with the card in physical stores,while 24% used it for money transfer and online payments with the physical card, but also as an economy service through the Vaults service.

We were curious to see how open are Romanians at the novelties in the banking area and how much of them use or would use Revolut’s services. Our study shows that Revolut represents an interesting alternative, but at the same time, there is also a certain reluctance in using this type of service. Still, it is notable the fact that 64% of the Romanians living in urban want more digitalized banks in Romania,while 44% of them declared that they would give up the services of the traditional bank in the favor of an digitally exclusive bank, which means that the Romanians are open to trying new products and banking services,” said Andrei Cânda, Managing Partner, iSense Solutions.

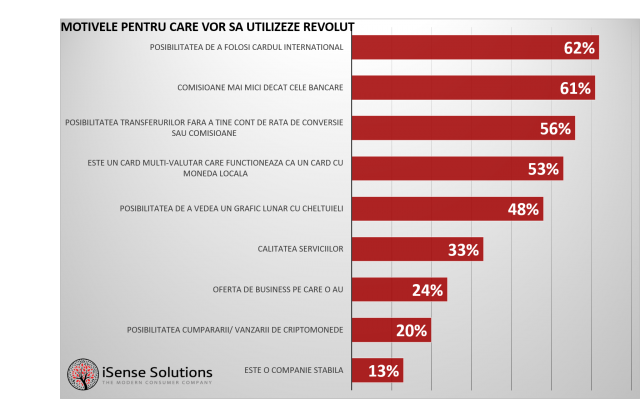

Although half (52%) of the urban population declared that would use Revolut (after they were presented the service), the iSense study identifies also a series of barriers that Romanians have regarding this app. When it comes to the payments and operations, most of them declared that are more restrained in doing transactions through the service offered by Revolut. The reasons are various. 53% wouldn’t use this digital service because they are happy with the services they have at the actual bank they are using. Moreover, almost a quarter, (24%) of the participants said that they don’t trust the support offered exclusively online,while 14% said they don’t have sufficient trust in the company. Still, 68% from the Romanians in urban declared that they would trust more the digital banks if they were under the umbrella of a traditional bank. On the other hand, the Romanians that said they would use Revolut would do it to use it internationally (62%) and thanks to the smaller commissions than the banking ones (61%). 48% of those whom would use Revolut are attracted by the possibility of seeing a monthly graphics of the spendings and 20% would do it for the possibility of trading cryptocurrency.

The study was realized online by iSense Solutions, on a sample of 990 respondents from urban. The data are representative for the persons with the age over 18,in urban Romania. The error margin is +/- 3.11%, at a 95% level of trust.