ZenithOptimedia: 4.1% growth forecasted for global adspend in 2013

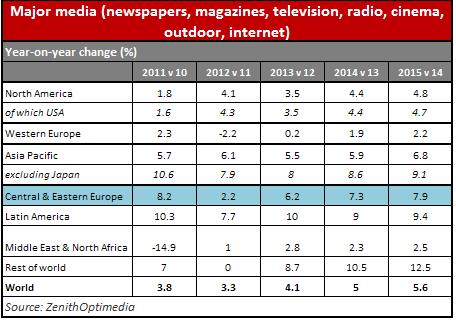

ZenithOptimedia expects the global ad expenditure growth to strengthen over the next three years, rising from 3.3% in 2012 to 4.1% in 2013 and 5.6% in 2015, with developing markets generating 61% of adspent growth between 2012 – 2015 and increase their share of global adspend from 34% to 37%.

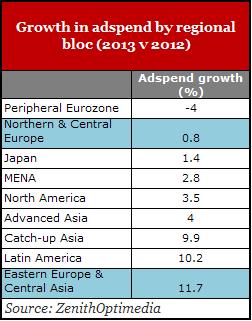

Strong growth is expected from Eastern Europe & Central Asia and Latin America, with a growth rhythm of 9%+ per year. In the same time, North America and “Advanced Asia” to post annual growth of 4%-5% annual growth. Periferal Eurozone will shrink 4% in 2013, stabilize in 2014 and post a 2% growth in 2015, while Northern & Central Europe will remain to the same level in 2013 and than start growing 2% per year in 2014 and 2015.

Among channels, online video and social media will help generate a 20% annual growth in internet display in the next 3 years, with internet advertising predicted to exceed combined newspaper and magazine total in 2015. Internet advertising is supplying most of the growth in expenditure by medium, with an estimated growth of 14.6% in 2013, while traditional media will grow by 1.7%.

Advertisers are willing to increase their budgets wherever they can achieve a strong return on investment (…) This means that developing markets, social media and online video are all growing rapidly, supporting continued expansion in global ad expenditure despite stagnation in the eurozone.

Steve King,

Global Chief Executive Officer ZenithOptimedia Group.

According to the report, ad market is slowly recovering from its decline in 2009 (9.6%), mainly because of the slow economic recovery. The Eurozone crisis in particular is dragging down economic growth at the moment, because it is in recession and its risk of collapse adds to global uncertainty, leading companies to hoard cash instead of investing in growth.

The main risks to growth in 2013 are the US automatic increases in tax and reductions in public spending that come into effect in January and the potential for further conflict in the Middle East.

ZenithOptimedia predicts ad expenditure will rise in step with GDP over the next three years, although ad expenditure growth will remain behind GDP growth throughout our forecast period.

In Europe, “PIIGS” markets (Portugal, Ireland, Italy, Greece and Spain) are included Peripheral Eurozone bloc, where ad expenditure will be down 15.3% by the end of 2012 and decline 4% more in 2013, with the region expected to stabilize in 2014 and start mild recovert (2.1%) in 2015. Northern & Central Europe – includes the rest of Western Europe, and Central European countries like the Czech Republic, Hungary and Poland – will see ad expenditure shrinking 0.2% in 2012 and grow 0.8% in 2013, then start recovering in 2014 and 2015 (+2.1% and +2.3%).

Eastern European & Central Asia – including markets like Russia and Ukraine, but also Azerbaijan and Kazakhstan – post high rates of economic growth and a low proportion of advertising to GDP. Therefore, the ad expenditure in Eastern Europe & Central Asia will grow 10.7% by the end of 2012 and the growth will be of 11.7% in 2013.

Ad expenditure in North America is much more robust than in Europe. Consumer confidence, retail sales, job numbers and house construction are all trending encouragingly upwards and so do ad expenditures, expected to go up 4.1% this year, but, without Olympics and political elections, the peace of growth will be of only 3.5% in 2013, followed by 4%-5% annual growth in 2014 and 2015.

US remains the biggest contributor of new ad dollars to the global market and, between 2012 – 2015, is expected to generate 28% of the total $76BN that will be added to global adspend. Seven of the ten largest contributors will be developing markets, contributing a further 44% of new adspend. Overall, developing markets will contribute 61% of adspend growth between 2012 and 2015, and increase their share of global adspend from 34% to 37%. US is seconded by China and Brazil as biggest contributors to admarket, followed by Indonesia, Russia, Argentina, Japan, South Korea, Germany and South Africa.

For 2015, ZO predicts shifts in what concerns the top 10 ad markets, although the top 4 – USA, Japan, China and Germany – will keep their ranks

Per medium, internet will continue to be the fastest growing one, with display to be the fastest-growing sub-category (+20% annually), thanks to the rapid rise of social media and online video advertising (each forecasted to grow 30% a year). Display advertising, that grows faster than paid search, accounted for 38% of internet advertising in 2012 and is expected to increase to 43% by 2015.

As Internet has risen on the expense of print, it will increase its share of the ad market from 18.0% in 2012 to 23.4% in 2015, while newspapers and magazines will continue to shrink at an average of 1% a year. Internet is also the biggest contributor of new ad dollars to the global market, with it to account for 59% of growth in total expenditure, followed by TV (39%).