UK: Advertising spend up 3% in H1 2013, all time high forecast for 2014 – an all time high

UK advertising spend rose 3% in H1 2013, which lead to a revised forecast for 2014, that points out to an all time high of £18.7bn in money spend for advertising, according to the latest Advertising Association/Warc Expenditure Report, the figures and forecasts that the advertising industry relies on.

In 2013, until now, total ad spend in UK reached to £8.54bn in H1, after a 2.3% growth in 2012, when spend reached £17.2bn, at the pre-recession levels (2007).

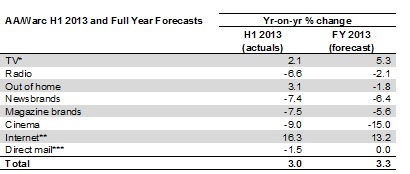

The first half of the year was driven by growth of internet pure play (+16.3% YOY), out of home (+3.1% YOY) and TV (+2.1% YOY), offsetting declines for all other media.

Strong growth for mobile (+128%) and search (+18%) helped drive total internet adspend up for the period, while OOH experienced a strong second quarter (+5.9%) after a flat start to the year.

AA/Warc full year adspend forecasts have been upgraded from the July 2013 report and now stand at 3.3% growth for 2013 and 5.2% for 2014, with expenditure set to reach £17.7bn in 2013 and an all-time high of £18.7bn in 2014.

The forecasts have been revised to reflect the better than expected outlook for search and TV advertising spend, as well as the improved economic scenario for the UK next year.

These numbers suggest growing confidence and that is good news – not only for UK advertising but for the consumer goods, digital and creative industries it underpins

Tim Lefroy,

Chief Executive Advertising Association

The AA/Warc Expenditure Report is the definitive measure of advertising activity in the UK. As the only impartial source of quarterly adspend figures and forecasts, it is considered the most reliable picture of the industry by advertisers, agencies and media owners.

The Advertising Association/Warc quarterly Expenditure Report is the definitive guide to advertising expenditure in the UK and the only source of historical quarterly adspend data and forecasts for the different media for the coming eight quarters. With data from 1982, this comprehensive and detailed review of advertising spend includes The AA/Warc’s own quarterly survey of all national newspapers, regional newspaper data collated in conjunction with the Newspaper Society and magazine statistics from Warc’s own panels. Data for other media channels are compiled in conjunction with UK industry trade bodies and organisations, notably the Internet Advertising Bureau, the Outdoor Media Centre, the Radio Advertising Bureau and the Royal Mail. The survey was launched in 1981 and has produced data on a quarterly basis ever since.

Advertising is a vital enabler in the economy, underpinning at least £100 billion of UK GDP. The Advertising Association (AA) is the single voice for those businesses and industries which contribute to that effect – the agencies that create and buy campaigns, the commercial media that carry them and the vast array of brands that use advertising to communicate with customers and drive their businesses. The AA’s remit is to protect and promote the role, rights and responsibilities of advertising. It works to keep advertising high on the business agenda, develop support and understanding in government and ensure that responsible practice earns the continued confidence of the public, regulators and policy-makers alike.

Warc is the global provider of ideas and evidence to marketing people. It has produced trusted and independent data on advertising expenditure and media costs for more than 25 years, and has partnerships with leading advertising organisations in more than 80 countries. Warc’s premium online service is the largest single source of intelligence for the marketing, advertising and media communities worldwide